For decades, analysts and experts have predicted the downfall of the branch. There are times, especially over the last five years, they appeared to be right. Yet, the branch remains at the center of the banking experience, driving business value for financial institutions of all sizes. In this on-demand webinar from her keynote at BankSpaces, Adrenaline’s President and CEO Gina Bleedorn presents the latest branch banking data and trends, reasons behind the branch paradox and the path forward. She explains how a bank can be opening branches at the same time they’re closing others and why branch footprints inside the branch are shrinking while the network of branches expands.

The branch is really all about people – a space where people come together. The branch endures because people want a place for humans to connect. Evidence of this need for connection in banking is everywhere. Just this past spring, Chase and PNC each announced massive investment in their branch networks, with Chase planning to open 500 new branches and renovate 1,700 more by 2027. When asked why Chase has such a commitment to the branch, CEO Jamie Dimon described bank branches as “deposit gathering machines” and reported plentiful paybacks, including more digital engagement in markets with branches.

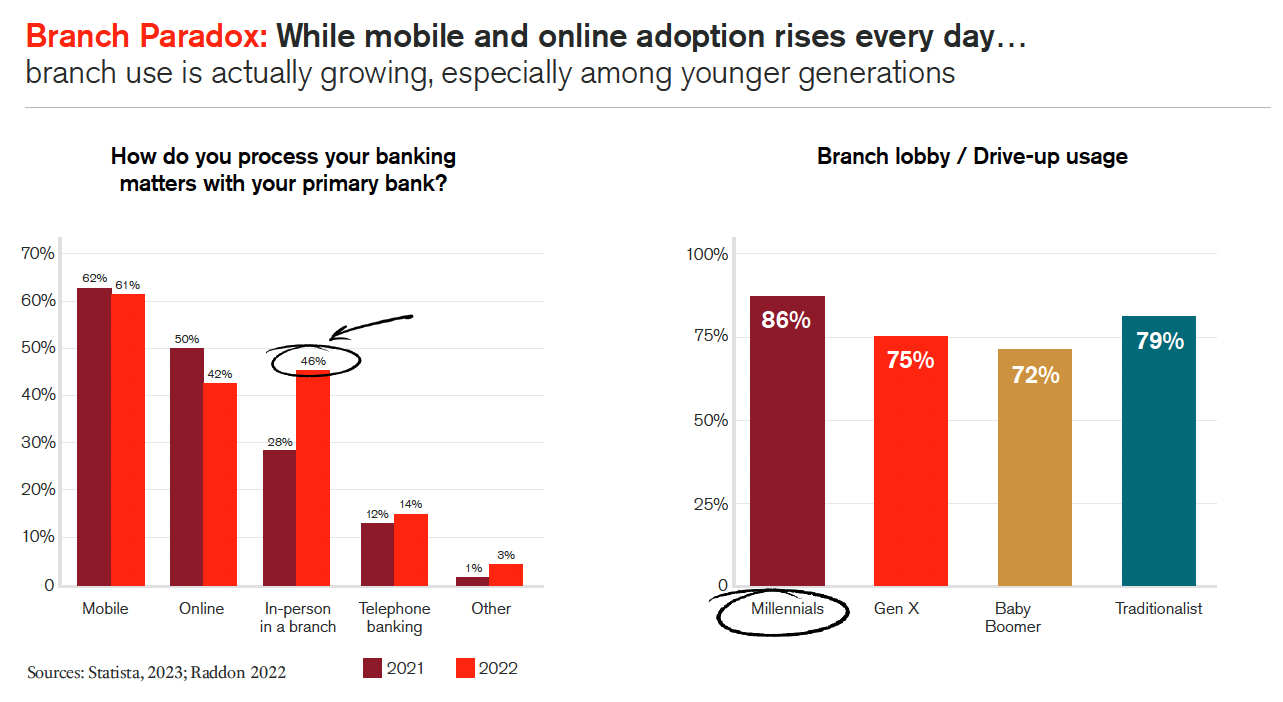

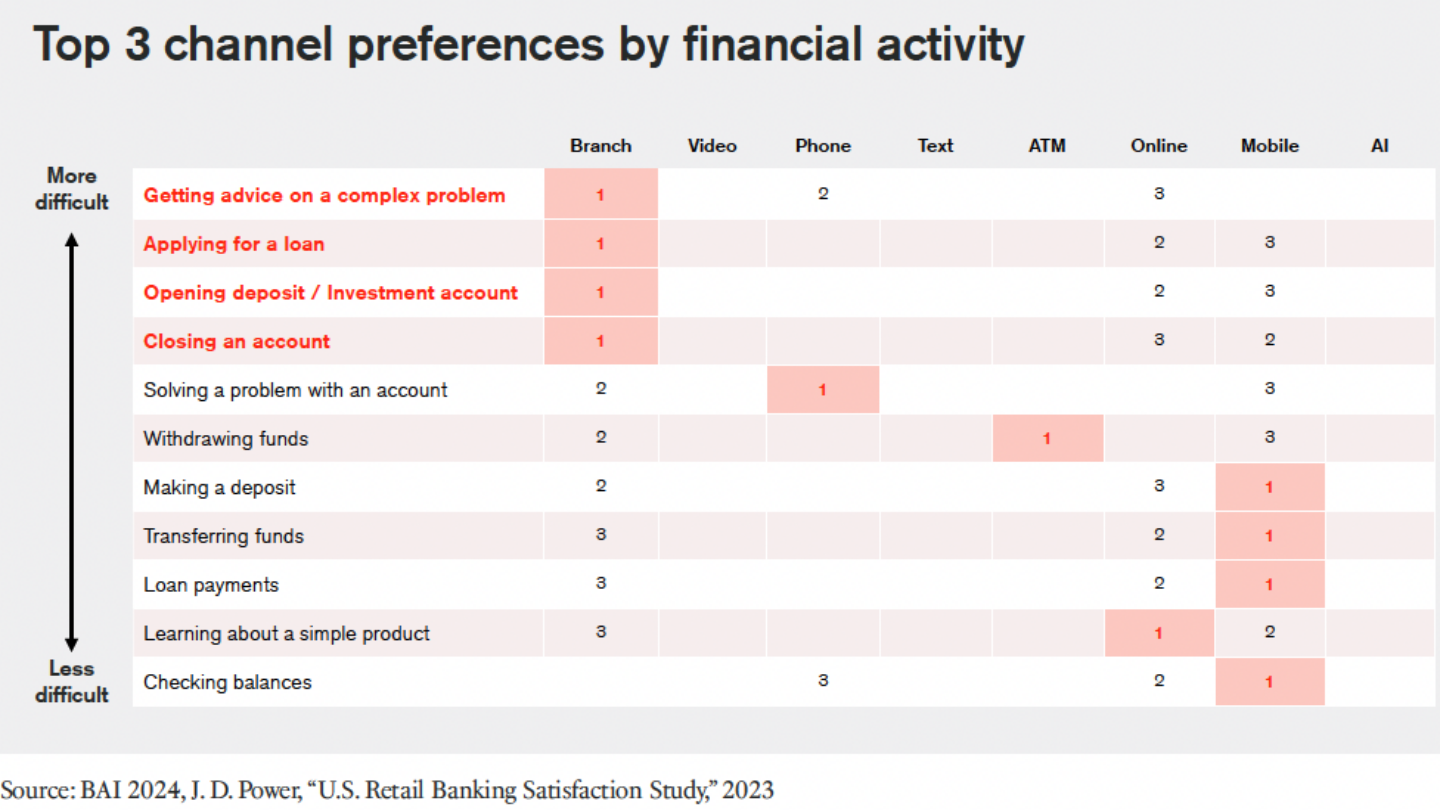

It may seem like a paradox, but consumers choose to use the branch, even while they increase use of mobile and digital banking. Branches continue closing while others open. Branch footprints are shrinking at the same time a bank’s overall branch network expands. Customers want digital convenience for transactions and physical interaction for complex needs. Bank branches are considered old school, but they’re also essential to our future, especially as Gen Z uses the branch three times more than Boomers. Ultimately, branch networks are a financial institution’s biggest expense and their greatest opportunity at the same time.

While it’s true that online account opening has reached record levels, the branch is why consumers choose their primary financial institutions in the first place. In fact, eight out of ten consumers say branch presence is a top consideration for them when they’re opening an account. After fees, branch access is the second most important feature for consumers when shopping for a checking and savings account, according to Forbes Banking Consumer Survey, ranked more important than mobile apps, customer rewards, ATM networks, and interest rates.

While the industry’s closed-to-open rate for bank branches is dropping, branch network investments are on the rise. The branch footprint is shrinking, making way for new branch models. Bank and credit union branches are now connection centers that build trust through human relationships, ultimately driving deposit growth and wallet share. And the opportunity the branch offers is enormous, with one in two banking customers opening new accounts after receiving effective financial advice. Yes, branches are getting smaller, but that’s not because their purpose is shrinking. In fact, quite the opposite is true. They’re making way for a for a new purpose – financial advice and guidance.

To learn more about branch optimization and network transformation for financial institutions, or to speak with one of Adrenaline’s experts, contact us today.

Adrenaline is an end-to-end brand experience company serving the financial industry. We move brands and businesses ahead by delivering on every aspect of their experience across digital and physical channels, from strategy through implementation. Our multi-disciplinary team works with leadership to advise on purpose, position, culture, and retail growth strategies. We create brands people love and engage audiences from employees to customers with story-led design and insights-driven marketing; and we design and build transformative brand experiences across branch networks, leading the construction and implementation of physical spaces that drive business advantage and make the brand experience real.